Lessons I Learned From Tips About How To Apply For A Federal Identification Number

Before filing form 1041, you will need to obtain a tax id number for the estate.

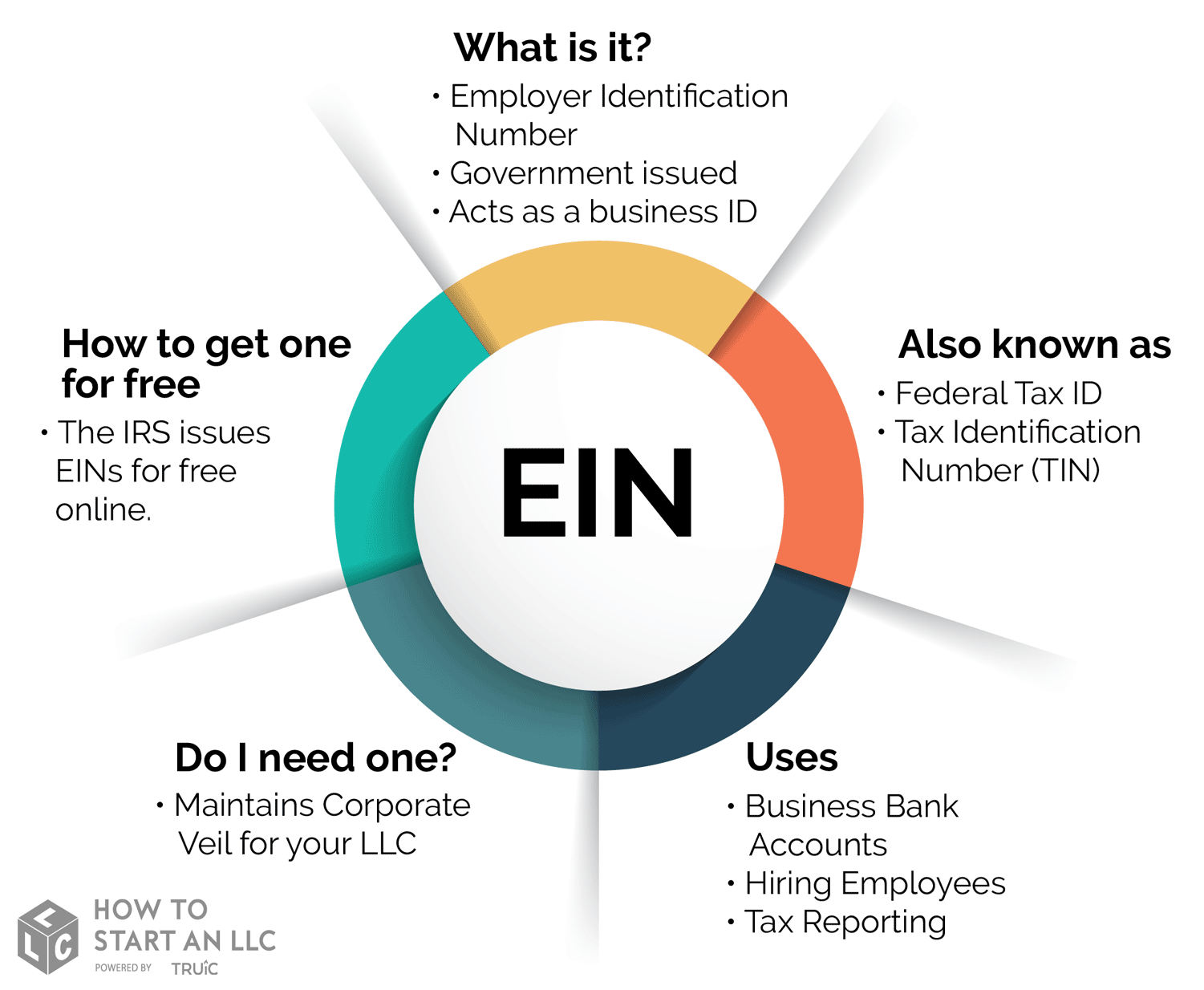

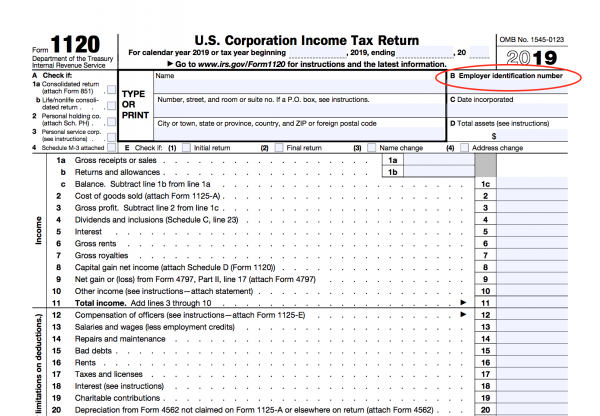

How to apply for a federal identification number. How do you get a federal id number? As the withholding agent, you must generally request that the payee provide you with its u.s. An employer identification number (ein) is also known as a federal tax identification number, and is used to identify a business entity.

If any of the follow apply to your business or entity you will need an ein: Get an fein online fast and easy. An employer identification number (ein) is also known as a federal tax identification number, and is used to identify a business entity.

Yes, estates are required to obtain a tax id: Have all assets appraised to. As mentioned previously, the federal tax id number is your business’s ein.

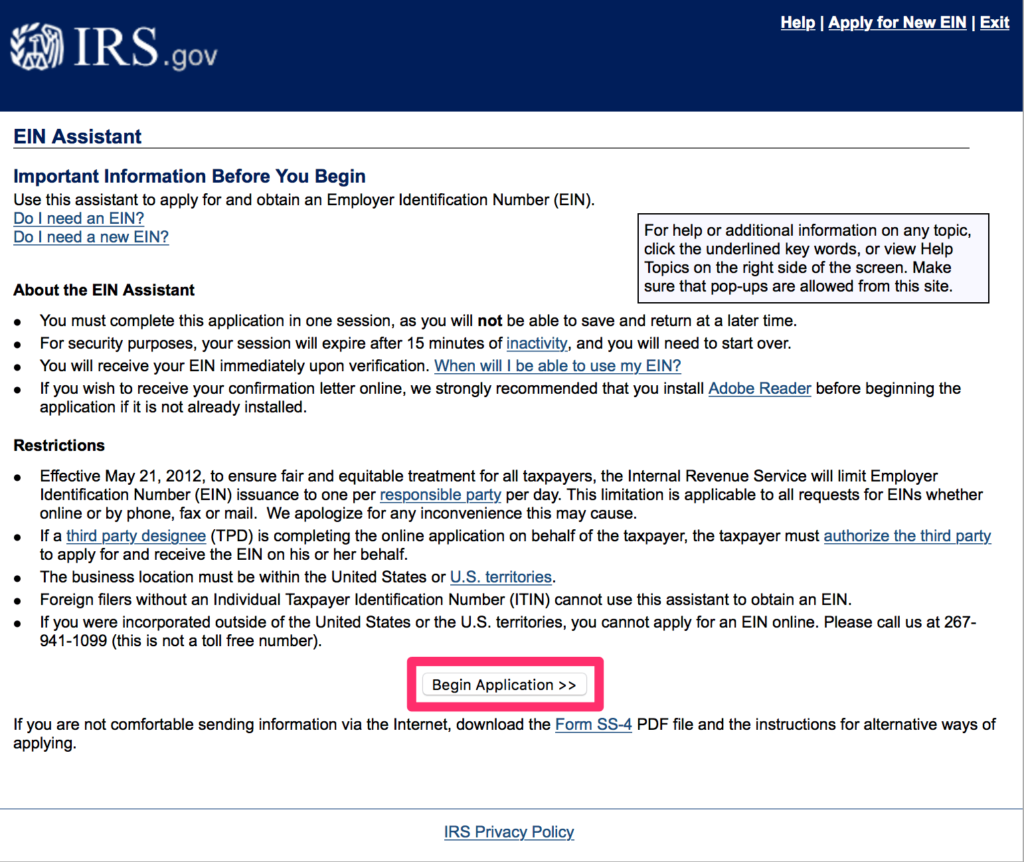

Ad federal taxid number application. Your first responsibility as an estate administrator is to provide the probate court with an accounting of the assets and debts of the deceased. The irs will mail a hard copy to you, but you should request an additional confirmation letter so.

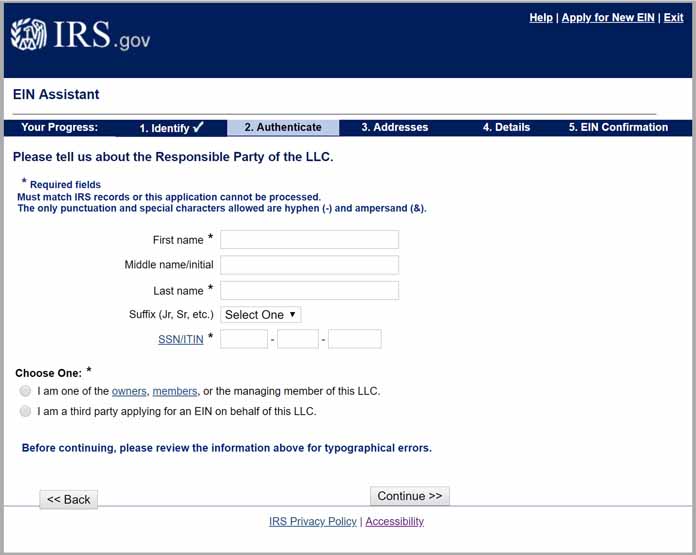

Once the irs issues an ein for your west virginia llc, you will receive your official approval, known as an ein confirmation letter (cp 575). Your state tax id and federal tax id numbers — also known as an employer identification number (ein) — work like a personal social security number, but for your business. The decedent and their estate are separate taxable entities.

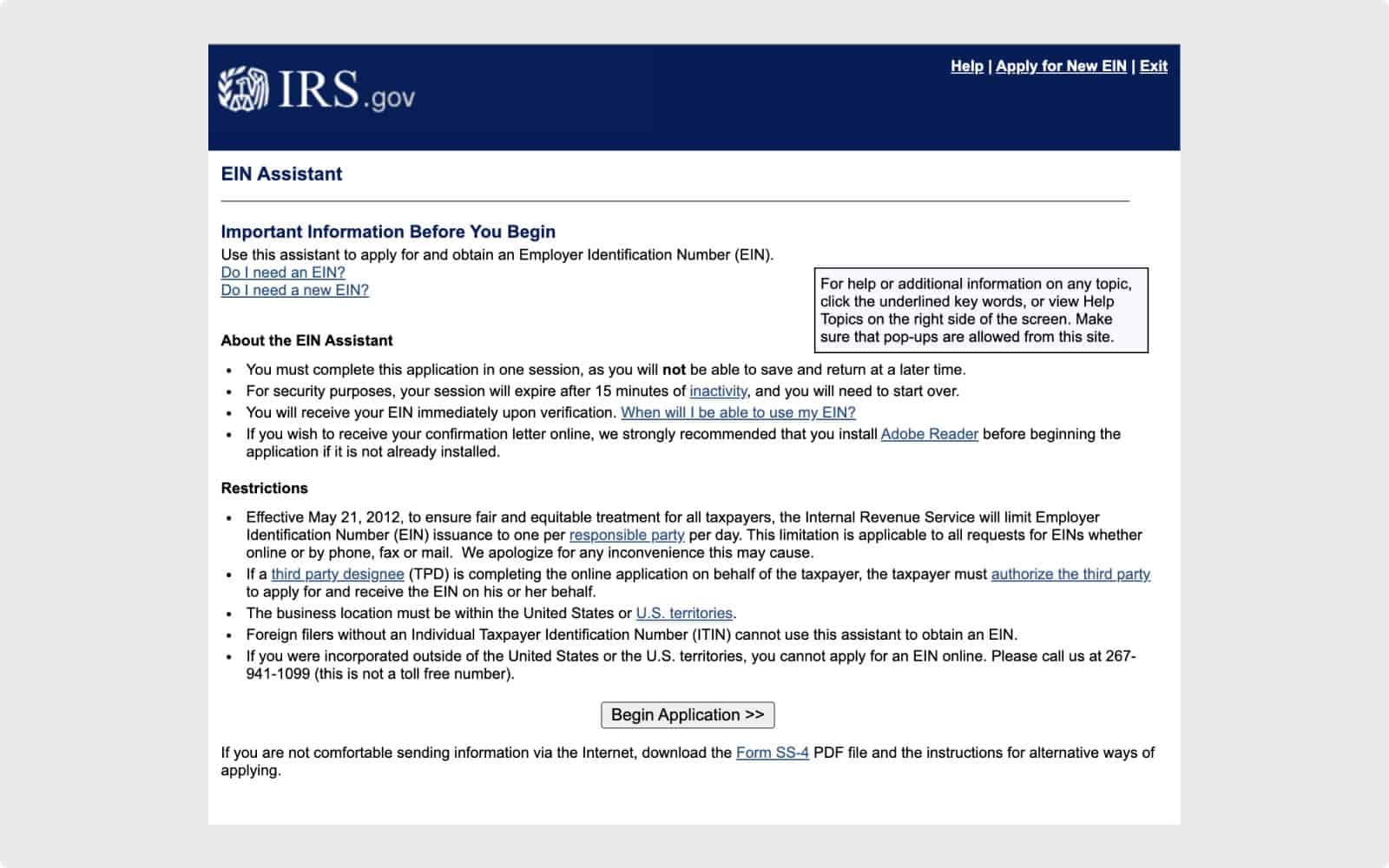

As soon as you finish the application and submit it, you will receive your number. The method you use to apply for an. The easiest way to apply for an fein is online.

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg)