Cool Tips About How To Become Tax Exempt In New York

Register as a tax return preparer and as a facilitator, pay the $100.

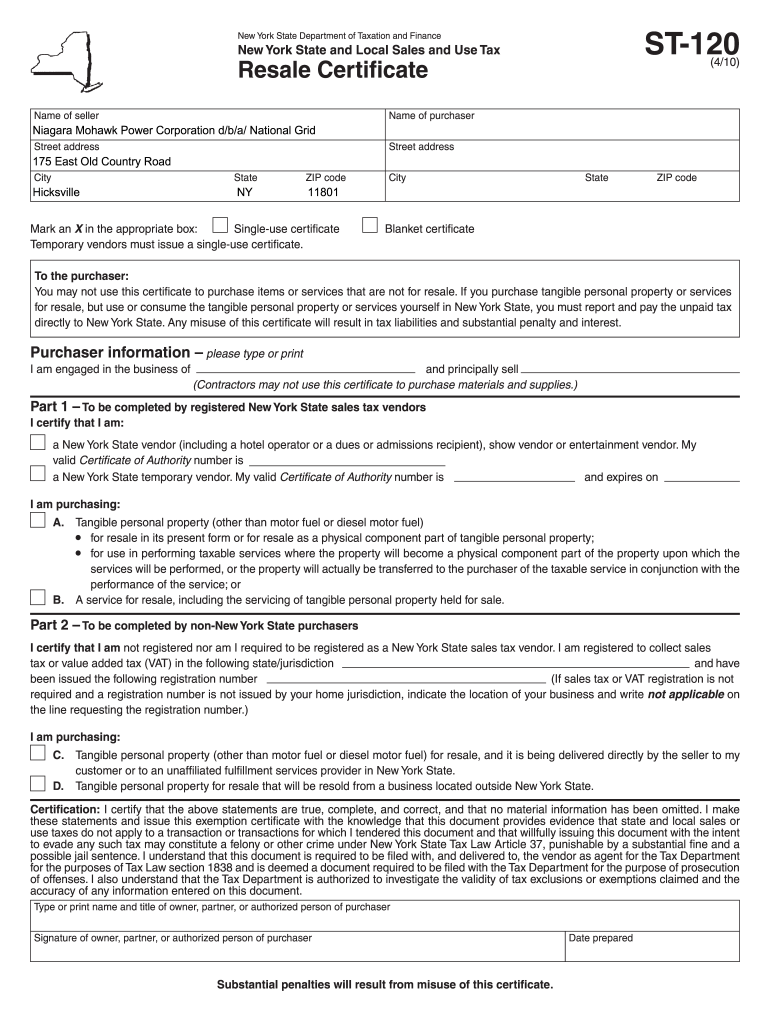

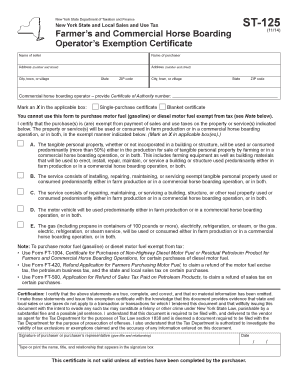

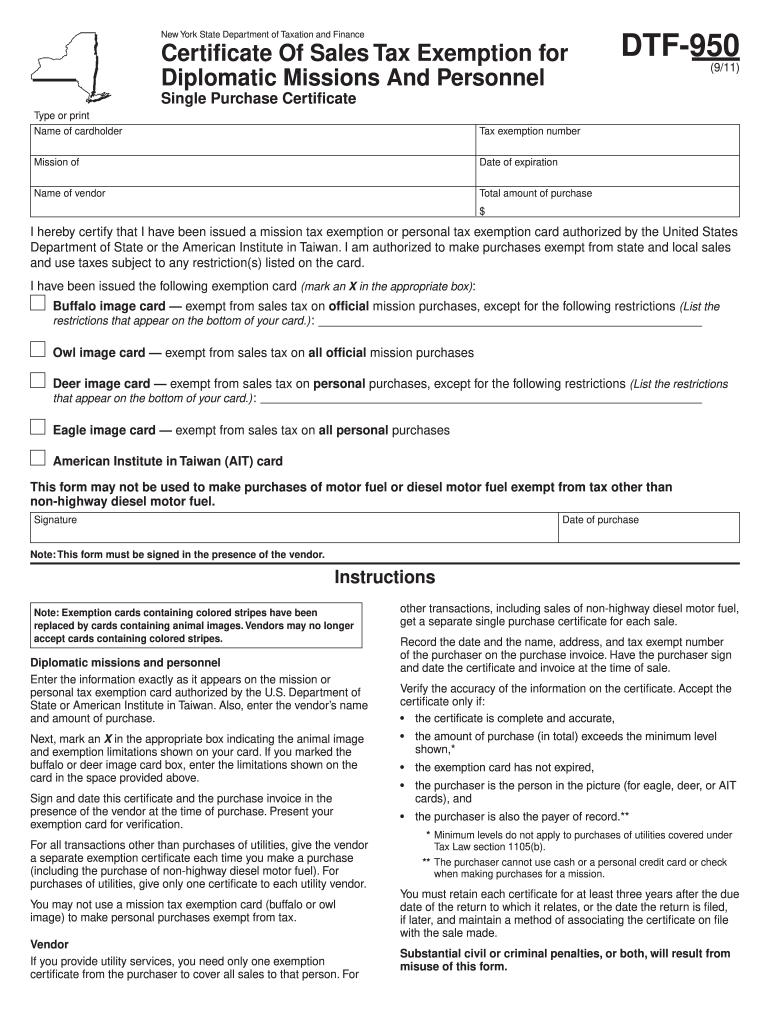

How to become tax exempt in new york. To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse. Several examples of exemptions to the state sales tax are over the counter prescription medications, certain types of food and groceries, some types of medical devices, family planning products, some types of machinery and chemicals. New york state department of taxation and finance :

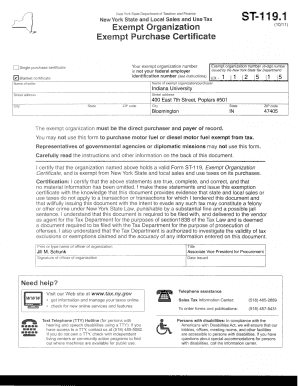

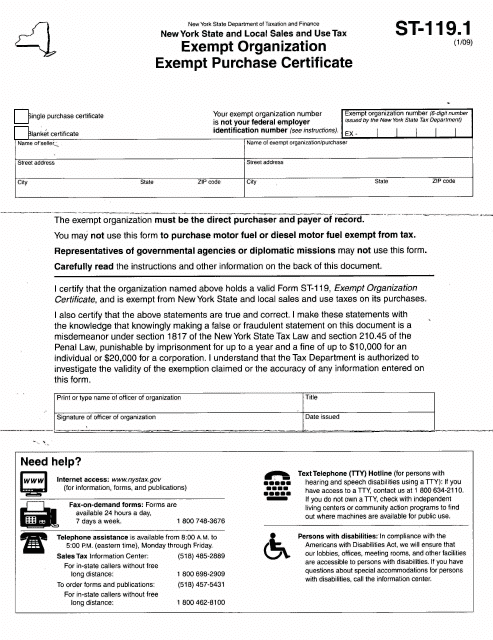

Facilitate rals or racs, are considered a commercial tax return preparer and a facilitator, and must: New york sales tax exemption for a nonprofit. How do i get new york state sales tax exemption?

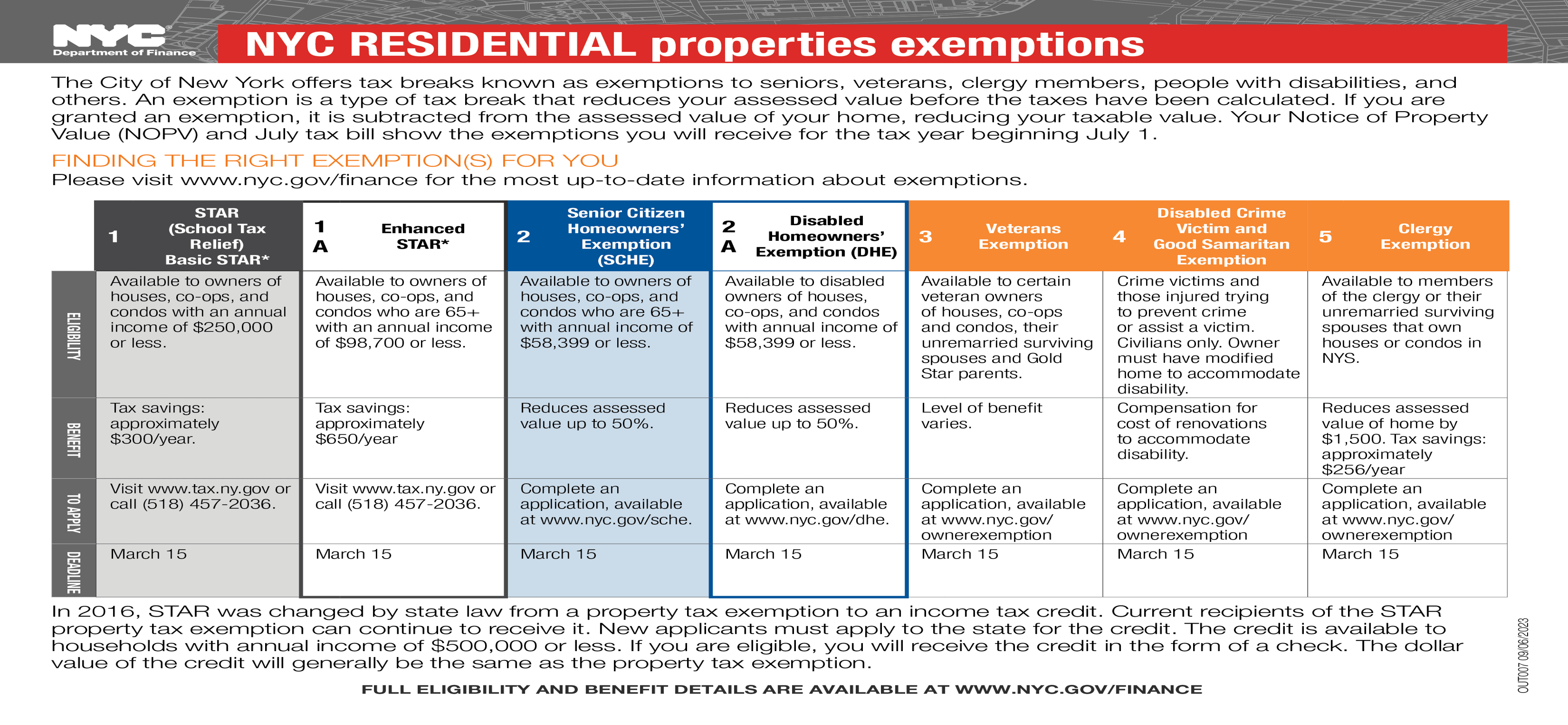

All about the senior citizen property tax exemption in new york. Agricultural assessment applies only to land and any posts, wires and trellises used to support vines or trees for the production of fruit on eligible land. New york recognizes the tax exemption granted by the irs.however, in order to receive exemption from new york state sales tax, you must apply to the new york state department.

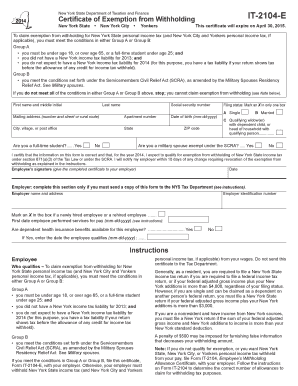

How do i become exempt from ny state taxes? To claim exemption from new york state and city withholding taxes, you must certify the following conditions in writing: In some states, your organization is not automatically exempt from state sales tax, even after obtaining 501 (c) (3) recognition from.

One method that can reduce your tax bill is applying for a tax exemption, such as the senior citizen property tax exemption. Star (school tax relief) senior citizens exemption. 25 rows new york state and local sales and use tax exempt use certificate:

These certificates are issued by the new york state department of taxation and finance. Paying sales tax on items for your farm. Applying for tax exempt status.